For decades, the debate over Thailand’s premier real estate investment destination has typically centered on Bangkok’s urban liquidity versus Phuket’s established coastal tourism. However, as both of those markets grapple with the pressures of mass development and saturation, a quieter, more resilient, and fundamentally premium market has consistently delivered outstanding value and appreciation: Koh Samui.

Unlike its densely-developed rivals, the island of Koh Samui has carefully cultivated an image of exclusive, low-density luxury. This is no accident; it is the direct result of strict, island-specific building regulations that have restricted supply and channeled investment almost exclusively into the high-end private villa sector. This strategic scarcity, combined with a post-pandemic surge in high-net-worth tourism, has cemented Koh Samui’s status as a top-tier destination for foreign buyers seeking both superior lifestyle value and robust financial returns.

The question is no longer if you should invest in Thailand, but where. This 2,500-word guide provides a deep-dive analysis of the Koh Samui property investment market for 2025 and beyond. We will break down the crucial market differentiators, provide a data-driven ROI comparison, dissect the legal landscape for foreign ownership, and identify the hottest emerging investment zones. By the end, you will understand why Koh Samui represents not just a real estate purchase, but a secure, long-term asset play in one of Southeast Asia's most resilient luxury markets.

The structural resilience of the Koh Samui real estate market is its greatest strength, setting it apart from other popular Thai destinations. This resilience is born from a critical factor: the deliberate restriction of supply.

The local government has implemented stringent building and zoning laws designed to protect the island's natural landscape and prevent the kind of urban sprawl seen elsewhere. These regulations are the single most important driver of sustained property value in Samui.

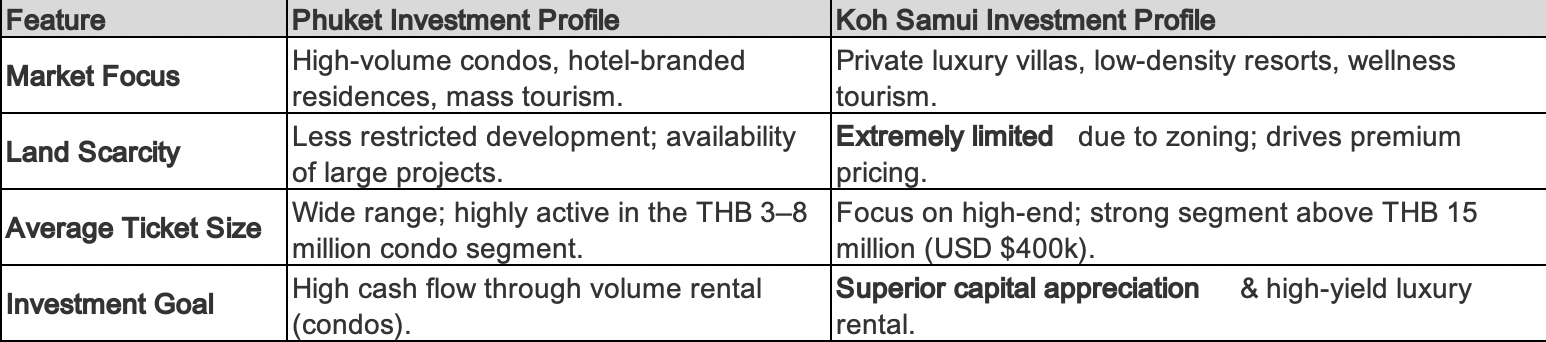

Savvy investors naturally compare the two major Thai island markets. While Phuket has a larger overall market value (over THB 30 billion) and superior international connectivity, its investment profile is fundamentally different from Samui’s.

In short, Phuket is geared towards the wider market, whereas Koh Samui targets a discerning, high-net-worth investor profile who values privacy, space, and a resilient asset.

The typical buyer in Koh Samui is a cash purchaser (local mortgages are rare for foreigners) from Europe, Asia (Hong Kong, Singapore), or the Middle East. They are generally buying for one of three reasons:

The true measure of a real estate market is its return profile. Koh Samui offers a powerful dual-return opportunity: strong rental yields (cash flow) combined with robust capital appreciation (asset growth).

Rental Yields: Luxury Villas Lead the Charge

The bedrock of Samui’s investment appeal is its luxury villa rental market, which has outpaced standard condo yields.

While rental yields provide income, capital appreciation delivers wealth. The limited availability of titled land, particularly with Chanote title (the most secure form of ownership), is the prime factor here.

Choosing the right sub-market is crucial for maximizing Koh Samui Property Investment ROI.

One of the most critical elements of a secure Koh Samui Property Investment is understanding the legal framework of Foreign Ownership Thailand 2025. While Thailand restricts direct foreign freehold ownership of land, secure, long-term control of assets is achievable through established, legal structures.

For those preferring a simpler, direct ownership structure, condominiums are the solution.

Understanding the costs of transaction is vital for true ROI calculation. While complex, a reputable lawyer will manage these on your behalf. Standard taxes and fees, including Transfer Fees (2%), Specific Business Tax (3.3%), and Stamp Duty (0.5%), generally amount to approximately 6% to 6.3% of the property's registered value. Rental income is subject to personal income tax, making professional financial planning essential.

The market is dynamic, and future-proofing your Koh Samui Property Investment requires an eye on emerging trends and infrastructure development.

The discerning global buyer is increasingly looking for sustainability. The most successful new developments are incorporating:

Investment in local infrastructure directly correlates with appreciation. Samui International Airport (USM) remains a critical asset, ensuring the island maintains its premium appeal through high-cost regional flight connectivity. Ongoing municipal projects, including road upgrades, improved water management, and the rollout of high-speed fibre-optic internet, are making once-remote areas more viable for high-end residential living. These improvements solidify Samui's position not just as a holiday destination, but as a viable location for long-term expatriate residency.

The difference between a mediocre 3% yield and a superior 8% yield in Koh Samui often comes down to management. A luxury asset requires luxury service.

The definitive answer to whether Koh Samui is the best place to invest in Thai property is found not just in its stunning beaches, but in the rigorous market fundamentals. It is the clear choice for the investor whose priority is quality over quantity, and whose strategy is focused on preserving and growing high-end capital in a world-class luxury destination. The island’s restrictive building codes act as a powerful economic filter, ensuring prime property remains scarce, exclusive, and therefore highly valuable.

For the serious international investor, Samui presents a unique and compelling narrative: a resilient asset class (the private pool villa) that delivers both high, stable short-term rental income (superior ) and a strong guarantee of long-term capital appreciation driven by finite land supply.

The time to secure a stake in this market is now, before the limited, premium inventory is fully absorbed by the accelerating demand for exclusive, tropical living.

While this guide provides the foundational knowledge and the macro-market analysis, navigating the specifics of land title deeds, optimal ownership structures, and current off-market opportunities requires expert, localized assistance.

Your investment journey is unique. Whether you are focusing on a high-yield rental villa in Bophut, a retirement home near Maenam, or a strategic land purchase for future development, the best investment decision is always an informed one.

Do not navigate the complexities of Thai property law and the luxury market alone.

Ready to transform these insights into a profitable reality?

We invite you to visit us today to discuss your specific financial goals, clarify the legal requirements for foreign buyers, and explore our exclusive portfolio of verified, high-ROI properties.

Connect with a Conradproperties Specialist and schedule your confidential consultation. Contact Us

What is a realistic rental yield for a luxury villa in Koh Samui?

A realistic net rental yield for a professionally managed luxury sea-view villa (after all operating costs) is typically in the range of 4.5% to 8% annually, with top performers exceeding this in exceptional years.

Is it safe for a foreigner to buy a house in Koh Samui?

Yes. Buying property in Koh Samui is safe when adhering to the law. Foreigners cannot own land freehold, but a properly registered, long-term leasehold ( year model) or a legally structured Thai Limited Company provides secure, long-term control over the asset. Always use an independent, qualified Thai lawyer.

How does Koh Samui compare to other global luxury markets on price?

Koh Samui remains highly competitive. A luxury, four-bedroom sea-view villa that might cost USD million in Samui could easily cost USD million+ in Bali, Phuket’s top tier, or the Caribbean, making Samui an excellent value proposition for the high-end buyer.

What are the biggest risks of investing in Samui property?

The primary risks are legal due diligence failures (especially regarding clear title deeds and unregistered leases), currency fluctuation, and poor management of the property in the demanding tropical climate. All are mitigable through professional local expertise. We can recommend our licensed legal lawyers who can assist you smoothly and guide through the process.

We’ve uncovered the 10 best Koh Samui properties for sale under ฿10 million THB—including modern pool villas and high-yield condos. Thi...

Thinking of buying an off-plan property in Koh Samui? Discover the benefits, risks, and key factors to consider before investing in a pre-construct...

With rising global interest in tropical getaways and a growing demand for luxury villas and sea-view homes, Koh Samui’s real estate market in...

The Ultra-Luxury market in Koh Samui operates on a simple principle: discretion is paramount. For properties valued at $...

Thinking of investing in Koh Samui property in 2025? Discover the latest trends, forecasts, and prime locations for property investment in this tro...

Discover the world of exceptional living with our guide to Koh Samui luxury real estate. This comprehensive overview highlights the exclusive prope...

Dreaming of waking up to panoramic ocean vistas from your private sanctuary? Koh Samui offers an unparalleled selection of luxury sea-view villas t...

Leave a reply